Investing is a key money move that helps ensure you’re able to achieve all your financial goals. So you should invest as much as possible, but keep in mind that investing comes with risks.

To figure out that maximum amount for your unique financial situation, you need to make a plan. Most of your budget is likely dedicated to covering basic expenses, like housing, transportation and food—your needs. Another portion goes toward your wants, like hobbies, dining out, going to the movies—the fun stuff. But some of your budget should be allocated toward future goals, like building up an emergency fund, going on a big vacation, buying a home and retiring one day—and that’s where investing comes in.

So how much is that?

Only you can determine your actual hard numbers. One budgeting model many experts recommend is the 50-30-20 rule—putting 50 percent of your budget toward needs, 30 percent toward wants and 20 percent toward saving and investing for future needs and goals. Of that last 20 percent, you should invest whatever you don’t expect to need for at least a few years. That time-frame allows you to take on the risk of short-term losses and ride it out to capture potential long-term gains.

So, if your monthly budget starts with $10,000, that means you should work to set aside $2,000—and depending on your goals, that’s the maximum you’d want to invest.

But one formula doesn’t work for everyone. Especially when you’re just starting out, your entry-level salary may feel like just barely enough to cover the necessities. Don’t sweat it. Just do the best you can, and save whatever amount makes sense for you to start.

How do you figure out how much is right for you? First, you have to get your priorities in order. Beyond covering your needs, identify your goals and decide for yourself what is important to you.

Maybe paying off debts is a top priority. In that case, you want to make a debt-repayment plan, first tackling high-interest-rate debts, like credit-card balances. But then maybe you can prioritize investing for the future ahead of paying off low-interest loans on the books, like student-loan debt or a mortgage, faster. You’d continue to pay down that debt, but invest some of your money at the same time.

Or if establishing an emergency fund is a big goal, you can first shoot to set aside at least $1,000 to start—that’s likely enough to cover a common unexpected expense like a car repair or a minor medical expense. But once you’ve done that, maybe slow down your efforts to fully fund your emergency account (which ideally would hold enough to cover three to six months’ worth of expenses). Then you can redirect some small portion of that savings to investing for the future, even if it’s just $50 or $100 a month.

Is it really worth investing such a small amount?

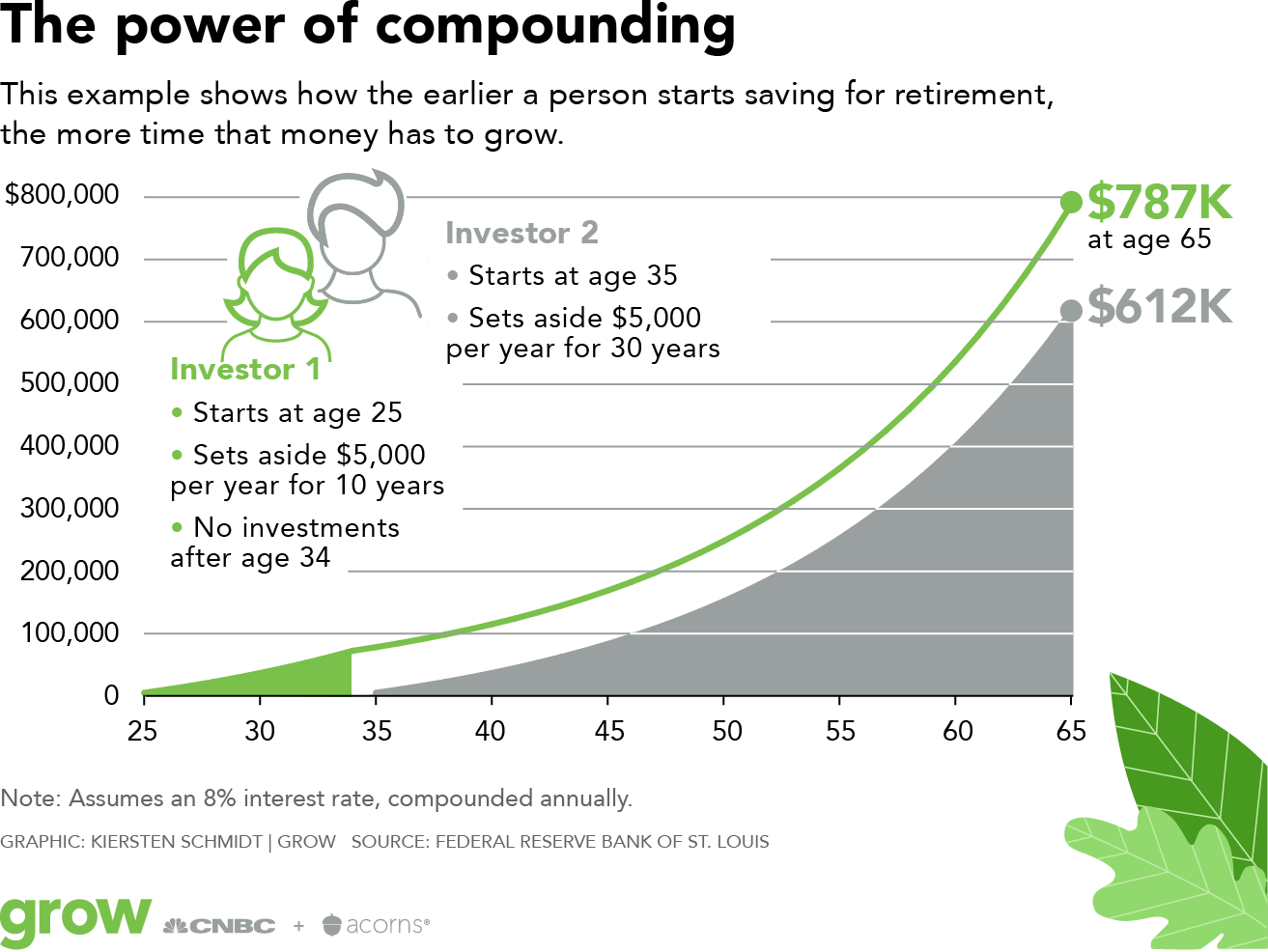

It may be small, but it is mighty. Given time, the little amounts you’re able to squirrel away in an investment account can grow into an impressive sum. (That’s why Acorns lets you start investing with just $5.)

Just look at the math: Let’s say you set aside $100 today, plus another $100 every month, at an interest rate of 1 percent compounded monthly, which is about what you can expect from a savings account these days (though with rates rising over the past couple of years, you may be able to do better). After 40 years, you’d wind up with more than $59,000. Not bad.

Even better: At a rate of 7 percent, which is a realistic average rate of return with a well-diversified stock portfolio invested for the long term, you’ll have nearly $250,000 after 40 years. Sure, that may not be enough to retire on, but remember that’s based on setting aside less than $25 a week.

Then what? How do I save and invest even more?

You’ll want to take advantage of inertia. That first step to start saving and investing—even just a small amount—can be the hardest. So once you get going, let your momentum propel you even further. Consider setting up recurring contributions to your savings and investment accounts to make it as easy as possible. Setting up regular investments also lets you take advantage of something called dollar-cost averaging.

What is dollar-cost averaging?

It’s a strategy that has you regularly invest the same amount of money over the long term. So if you automatically contribute to a 401(k) with every paycheck, for example, you are already dollar-cost averaging.

What are the advantages of dollar-cost averaging?

Not only does it allow you to start investing as soon as possible—rather than waiting until you’ve accumulated a big chunk of money to invest—it also helps ensure you’re buying more when prices are low and less when they’re high.

There’s also a psychological benefit: While the general direction of the markets is up over long periods, you can expect plenty of downs along the way. And that natural volatility inherent in investing can be a lot for anyone to stomach. Dollar-cost averaging can help calm any investing anxiety you may have because it forces you to follow a routine and roll with whatever market movements come each day. And while you may miss out on time in the market, you can benefit by scooping up more shares during the dips. Just be sure that you set up automatic contributions, so you’re not tempted to spend it instead.

Then try increasing the amount you save each month. Some retirement accounts may even offer an auto-escalation option, which would automatically increase your contributions. And whenever you get a raise, boost your monthly savings proportionately. Before you know it, those small boosts will add up to big savings, and you’ll reach that attractive model size of 20 percent a month—or even more.

What else can I do to maximize how much I invest?

Add in whatever extra you can. For example, if you’re lucky enough to score a bonus at work, a cash birthday or holiday gift, a tax refund, additional income from a side gig or some other special lump sum, consider putting it right to work and investing it. By going all-in with that windfall—rather than gradually investing it in smaller portions—you maximize the time that money spends in the market, which means more time for it all to potentially grow and benefit from compounding (i.e. when earnings grow on top of earnings and so on).

So what’s the best investing strategy for me?

Why choose just one? In general, you’ll probably need to employ some dollar-cost averaging because you’ll want to invest a little of each paycheck. But then you’ll also want to add in any lump sums you can afford to invest, if you’re comfortable putting that money in the market.

Whatever strategies you use, you should be investing through a tax-advantaged account like a 401(k) or IRA for retirement and a regular brokerage account for goals you want to reach before you’re 59½. (Acorns offers both.) Those are typically your best options for putting your investments to work and helping you achieve all your financial goals. And make sure to invest in more than a few stocks, so that even if some go down others may be up. Experts usually recommend a diversified portfolio with a broad mix of stocks and bonds.

* Investing involves risk including loss of principal. This information is provided for educational use only and is not a recommendation to buy or sell any specific security or invest in any particular strategy.

All investments involve risk including loss of principal. The chart shown represents hypothetical performance assuming a fixed annual rate of return of 8%, with earnings and dividends reinvested over the time periods shown. Such results do not represent actual investing results and does not take into consideration fees or economic or market factors which can impact performance. Clients may achieve investment results materially different from the results portrayed. The information shown is for illustrative purposes only and should not be considered as investment advice or a recommendation to buy or sell any particular security, strategy or investment product.